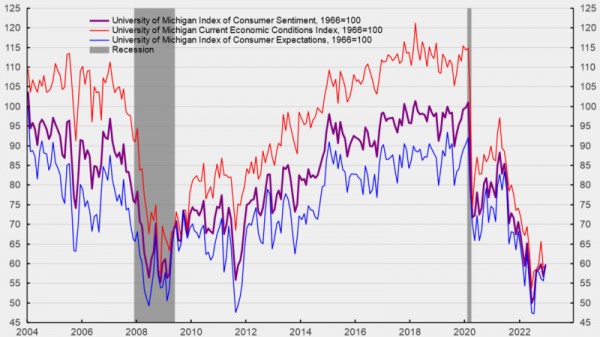

Market volatility was on full display this week, beginning with a sharp selloff on Monday (February 24) and exacerbated by a rollout of downbeat economic data, including a weak consumer sentiment report.

Those feelings were echoed in the findings of a Harris Poll conducted for Bloomberg News, which found that nearly 60 percent of US adults expect higher prices in 2025 if President Donald Trump’s policies are enacted.

Rising US jobless claims and fluctuating Personal Consumption Expenditures price index data on Thursday (February 27), coupled with Friday (February 28) numbers showing US consumer spending fell in January and a tense meeting between Trump and Ukrainian President Volodymyr Zelenskyy, intensified economic concerns.

The tech and crypto markets felt the impact of this uncertainty, with Bitcoin ultimately dropping below US$78,400 on Thursday night, over 20 percent lower than its price near US$100,000 seen last week.

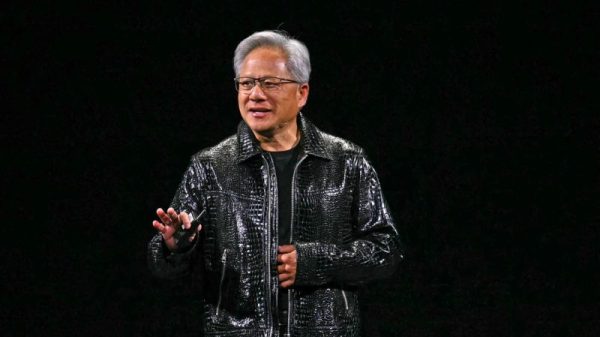

All Mag 7 stocks moved down on Tuesday (February 25) after the consumer sentiment report, with Tesla (NASDAQ:TSLA) leading the descent. Its market cap dipped below US$1 trillion after January data from the European Automobile Manufacturers’ Association showed 45 percent fewer Tesla registrations year-on-year. The carmaker ended the week down 13.24 percent. NVIDIA (NASDAQ:NVDA) and Palantir (NASDAQ:PLTR) also lost over 10 percent this week.

Amid these fluctuating market dynamics, Vinod Khosla, founder of Khosla Ventures, urged attendees at the Information’s AI Agenda Live conference in San Francisco to be selective when looking for artificial intelligence (AI) opportunities.

“Most investments in AI will lose money, but a few high-return outliers will offset the losses,” he said. “Right now, we’re in the greed cycle of investing because people see the momentum that’s been established in the market caps.”

With that, here’s a look at other key events that made tech headlines this week.

1. Spotlight on Cohere and NVIDIA’s AI advances

Software startup Cohere is making waves in the international AI market.

A Monday report from the Information reveals that the Canadian AI company, which develops large language models (LLMs), surpassed US$70 million in annualized revenue, a three-fold increase compared to last year.

In July 2024, the company was valued at US$5.5 billion. In January, it launched North, an “all-in-one secure AI workspace platform” that combines LLMs, advanced search and automation tools to help enterprises enable automation and streamline efficiency. Roughly 25 percent of its revenue growth is reportedly from international markets.

Such a drastic increase in revenue may not come as a surprise given Cohere’s strong backing by industry heavyweights like Salesforce (NYSE:CRM), Cisco Systems (NASDAQ:CSCO), Advanced Micro Devices (NASDAQ:AMD) and NVIDIA. The company’s professional relationships have been instrumental to its growth. Cohere’s Command R model was integrated into NVIDIA’s API catalog last year. Cohere has also secured a partnership with CoreWeave to build data centers in Canada, with the financial backing of the Canadian government and hardware supplied by NVIDIA.

NVIDIA itself released its latest quarterly results on Wednesday (February 26), reporting earnings per share of US$0.89, surpassing analysts’ estimates of US$0.85. It is projecting revenue of US$43 billion for the coming quarter.

Despite a slight dip in share price the day before its results came out, perhaps driven by potential restrictions on sales of its graphic processing units to China, the market reacted positively to NVIDIA’s performance. The company’s share price closed at US$131.28 on Wednesday, climbing to US$135.67 in after-hours trading. NVIDIA closed the week at US$124.92 per share, down 8.52 percent from Monday’s opening price.

2. Apple announces US investment and manufacturing plans

Apple (NASDAQ:APPL) started the week by announcing a US$500 billion investment in the US over the course of next four years. The company’s commitment includes a new manufacturing academy in Michigan, accelerated research and development efforts and a new 250,000 square foot manufacturing plant in Houston.

“The servers that will soon be assembled in Houston play a key role in powering Apple Intelligence, and are the foundation of Private Cloud Compute, which combines powerful AI processing with the most advanced security architecture ever deployed at scale for AI cloud computing,” the company wrote in a press release.

The center, which the company says will employ 20,000 workers, is slated to begin operations in 2026.

Trump recently revealed Apple’s intention to shift manufacturing from Mexico to the US after a meeting with CEO Tim Cook, preempting the company’s official announcement.

“He’s going to start building,” Trump told governors at the White House on February 21. “Very big numbers — you have to speak to him. I assume they’re going to announce it at some point.”

In a separate development, Apple finalized an investment agreement with Indonesia on Thursday, ending a five month deadlock that prevented iPhone 16 sales in the country. The agreement includes the construction of an AirTag manufacturing facility on Batam Island and another plant in Bandung, West Java.

3. OpenAI’s GPT-4.5 unveiled alongside BNY Mellon collaboration

BNY Mellon, America’s oldest bank, announced a multi-year partnership with OpenAI on Wednesday.

The agreement will give BNY Mellon access to OpenAI’s advanced AI tools, including Deep Research and its most advanced reasoning models. These tools will enhance BNY Mellon’s internal AI platform, Eliza. OpenAI aims to gain valuable insights into the real-world performance of its models for complex tasks through this collaboration.

This focus on advanced reasoning models is a key aspect of OpenAI’s broader strategy, even as it explores different facets of AI with its latest release, GPT-4.5, on Thursday. GPT-4.5 is the latest iteration of its language model, ChatGPT.

GPT-4.5 employs “unsupervised learning,” a type of machine learning where algorithms analyze and find patterns in unlabeled data. According to OpenAI’s CEO Sam Altman, the model exhibits greater emotional intelligence and is less likely to hallucinate than past models. “It is the first model that feels like talking to a thoughtful person to me,” Altman posted on X on Thursday afternoon following a press release. “(I) have had several moments where I’ve sat back in my chair and been astonished at getting actually good advice from an AI.”

Altman also explained that the model’s size and complexity demand substantial computational resources, delaying the release of the ‘plus’ tier until after “tens of thousands of GPUs” are added next week.

In addition, he clarified that GPT-4.5 is not a reasoning model and “won’t crush any benchmarks. (I)t’s a different kind of intelligence and there’s a magic to it (I) haven’t felt before.” In essence, GPT-4.5 represents advancement towards more intuitive AI capable of adaptable, meaningful and natural conversations.

4. CoreWeave eyes US$35 billion valuation in upcoming IPO

Cloud computing provider CoreWeave is reportedly considering an initial public offering (IPO) in the US. The official announcement could come within a week, according to sources for Bloomberg, who said the details of the plan are still being decided. Company representatives did not respond to Bloomberg’s request for a statement.

Bloomberg also reported on rumors of a CoreWeave IPO in November, with sources at the time saying executives had chosen prominent investors Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and JPMorgan Chase (NYSE:JPM) to lead. The company secured US$23 billion from Cisco Systems in October 2024.

CoreWeave is now seeking US$4 billion, targeting a valuation of at least US$35 billion.

5. Reports show Meta to build new AI data center

Meta Platforms (NASDAQ:META) is reportedly in talks to build a new data center campus to power its ambitious AI projects, valued at approximately US$200 billion. Sources familiar with the matter revealed to the Information that Meta executives are actively exploring potential sites in Louisiana, Wyoming and Texas.

However, a Meta spokesperson refuted these reports, reasserting the company’s previously disclosed capital expenditure and data center plans, confirming that those plans have been finalized.

In related news, CNBC reported on Thursday that Meta is preparing to launch a standalone app dedicated to its chatbot, Meta AI. This move would allow users to engage with and use the AI chatbot on a separate platform from the company’s other social media and messaging apps.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.