RTX and GE Aerospace expect a more than $1 billion impact combined from President Donald Trump’s tariffs on imported goods and materials, the latest sign of higher prices for major U.S. manufacturers that rely on a global supply chain.

Neil Mitchill, chief financial officer of defense contractor and commercial aerospace supplier RTX, said on an earnings call Tuesday that the company will likely take a $850 million hit this year from tariffs, including the sweeping 10% levies that Trump imposed earlier this month alongside higher duties on countries like China and separate taxes on imported steel and aluminum.

That estimate doesn’t include RTX’s own tariff mitigation measures, Mitchill said.

GE Aerospace, which makes engines for popular Boeing and Airbus planes, kept its 2025 earnings outlook in place during its quarterly report Tuesday and said it would seek to save about $500 million by cutting costs and raising prices.

GE Aerospace CEO Larry Culp said on Tuesday’s analyst call that he recently met with Trump and discussed the U.S. aerospace sector’s trade surplus. GE has a joint venture with France’s Safran to make popular airplane engines.

The new tariffs are a shift for a global industry that has enjoyed mostly duty-free trade for decades.

“All we have suggested is the administration works through a myriad of issues, is they can consider the position of strength that the country enjoys as a result of this tariff-free regime,” Culp said.

The White House didn’t immediately comment.

Boeing, a major customer of both companies and the top U.S. exporter, is scheduled to report quarterly results before the market opens on Wednesday.

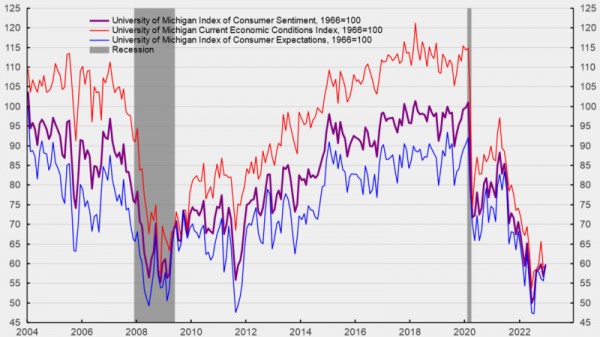

Airlines have recently announced cuts to U.S. domestic capacity plans this year because of softer demand, but executives have emphasized it is hard to predict the direction of the economy or future trade policies. United last week provided two earnings outlooks for 2025, one in the event of a recession, one assuming status quo.

“There is uncertainty,” Culp said Tuesday. “None of us, I think, know for sure how this plays out.”